WooCommerce EU VAT Number | Collect VAT numbers at checkout and remove the VAT charge for eligible EU businesses.

Selling across borders in Europe? The WooCommerce EU VAT Number extension can revolutionize your VAT management. It automates EU VAT number collection and validation, streamlining compliance and boosting sales. Learn more today!

Streamline Your European Sales with Automated VAT Management

Imagine this – a customer from across the border breezes through your checkout, VAT calculated and applied seamlessly. Sounds like a dream, doesn’t it? Well, with the magic of the EU VAT Number WooCommerce extension, that dream can become a reality for your online store.

For any business owner selling across borders in Europe, navigating the complexities of VAT (Value Added Tax) can feel like a bureaucratic maze. But fear not! This nifty little extension simplifies the process by automatically collecting and validating EU VAT numbers at checkout.

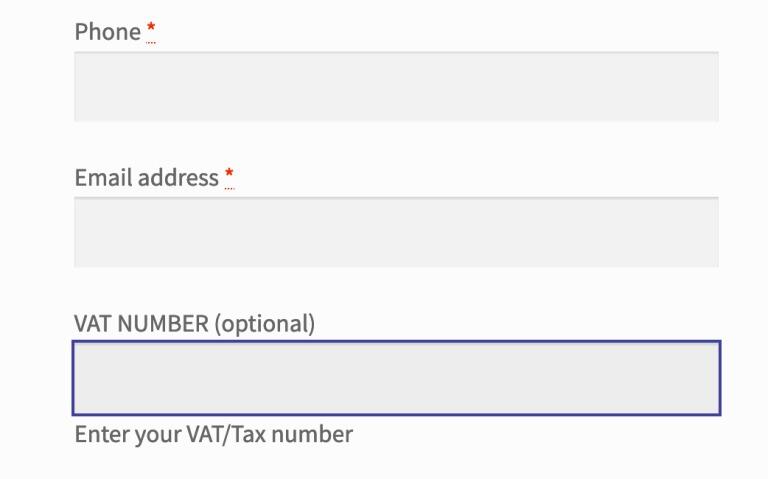

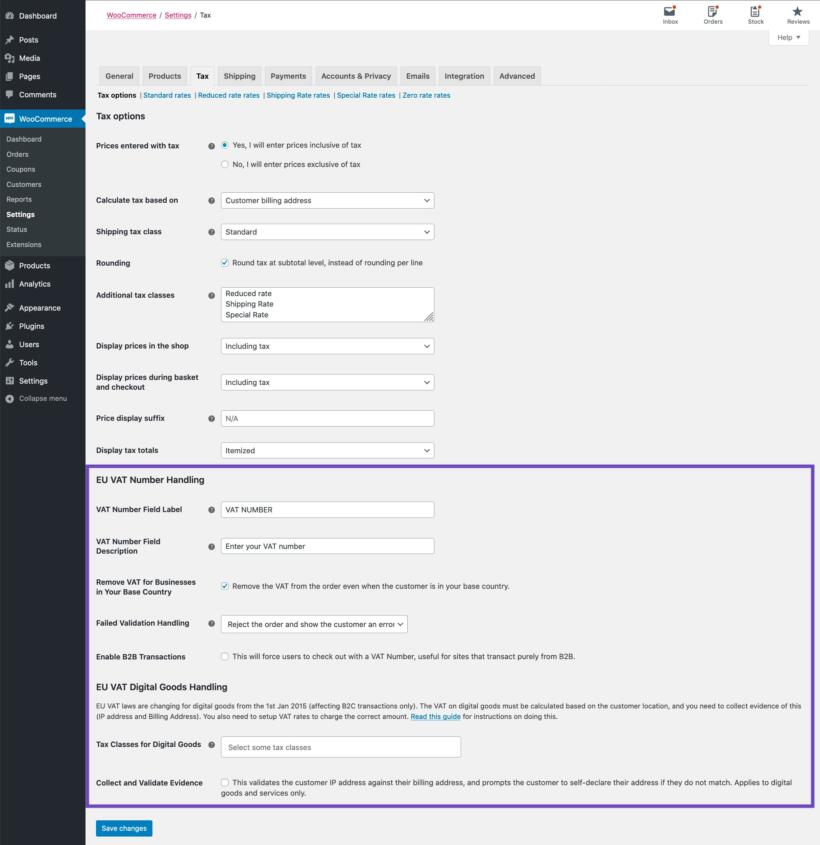

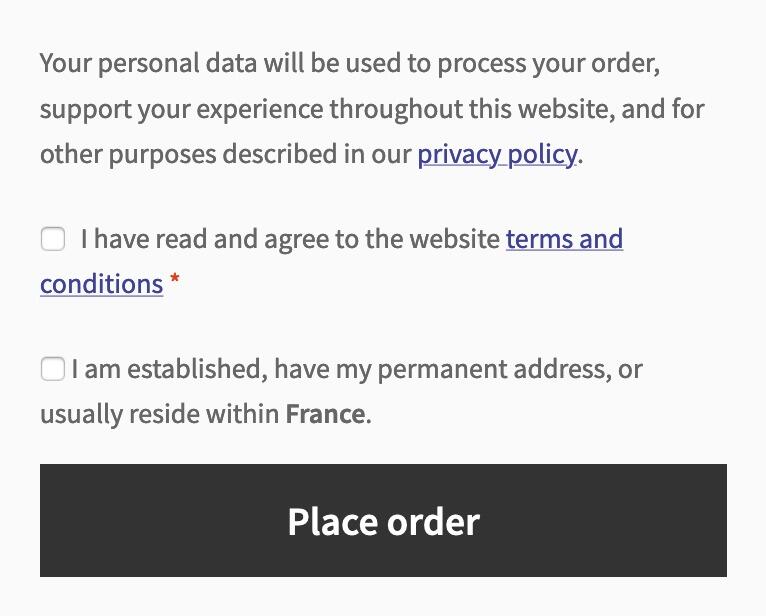

Here’s how it works: when a customer with a valid EU VAT number enters their details at checkout, the extension whirs into action. It verifies the number against the European Commission’s VIES database, ensuring its legitimacy. If the number checks out, the customer is automatically exempt from paying VAT, saving them money and making your products even more attractive.

But that’s not all! The EU VAT Number WooCommerce extension is a two-way street, benefiting both you and your customers. By streamlining VAT management, you can:

- Reduce administrative headaches: Say goodbye to manual VAT calculations and paperwork woes. The extension automates the process, freeing up your time to focus on what you do best – running your business.

- Boost sales conversions: By offering competitive VAT-exempt prices to eligible customers, you can incentivize purchases and watch your sales soar.

- Enhance customer satisfaction: Nobody enjoys grappling with complex tax forms. The extension provides a smooth checkout experience for your EU customers, leaving them with a positive impression of your store.

Whether you’re a seasoned cross-border seller or just dipping your toes into the European market, the EU VAT Number WooCommerce extension is an essential tool. It simplifies VAT compliance, saves you time and money, and ultimately helps you grow your business.

Here are some FAQs to shed light on any lingering questions you might have:

1. Do I need this extension if I only sell within my home country?

No, the EU VAT Number WooCommerce extension is specifically designed for businesses selling to customers across borders in the European Union. If your customer base is solely within your home country, you won’t need this extension.

2. What happens if a customer enters an invalid EU VAT number?

The extension will detect the invalid number and proceed with the standard VAT calculation for your country. The customer will not be exempt from VAT.

3. Does the extension automatically update exchange rates?

No, the EU VAT Number WooCommerce extension focuses solely on VAT management. You’ll need a separate currency converter plugin to handle exchange rate fluctuations.

4. Is the extension compatible with other WooCommerce plugins?

Absolutely! The EU VAT Number WooCommerce extension is designed to play nicely with other popular WooCommerce plugins. However, it’s always a good idea to check for compatibility before installing any new plugins.

5. Where can I find more information about the extension?

For a more in-depth look at the EU VAT Number WooCommerce extension, you can visit the official WooCommerce plugin store or consult the extension’s documentation.

WooCommerce EU VAT Number Nulled